I have always been interested in physics and mathematics, and science more generally. Coming from a general scientific engineer training and specialized in construction & civil engineering, it is as a structural engineer and project manager that I started my professional life, in Paris (France). This profession consisted in designing, dimensioning and supervising the design part of structures such as skyscrapers, hospitals, residential or office buildings, and other reinforced concrete or metal structures. You may wonder : “what’s the link with technical analysis?”, and you are right. I will explain to you my story which led me to become a freelance trader.

My interest in economics and finance came when I was 19 (right after high school and beginning of engineering graduate studies). In addition, from a very young age I was interested in developing my own projects, in being free in my way of working. When I finished high school (when I was 18) I naturally turned to fields like start-ups, business, finance and new technologies. It is also the moment when I discovered the notions of personal development, financial freedom and movements like FIRE (Financial Independence Retire Early). I was looking for a mean to be my own boss and to leave the world of salaried work as quickly as possible even if the fields of construction and structural calculations still fascinate me. I fully understand willing for being employed the whole life and I think this is an option that could have suited me if I had had a boss whom I admire (unfortunately I didn’t), but the the urges for independence and entrepreneurship were far too strong.

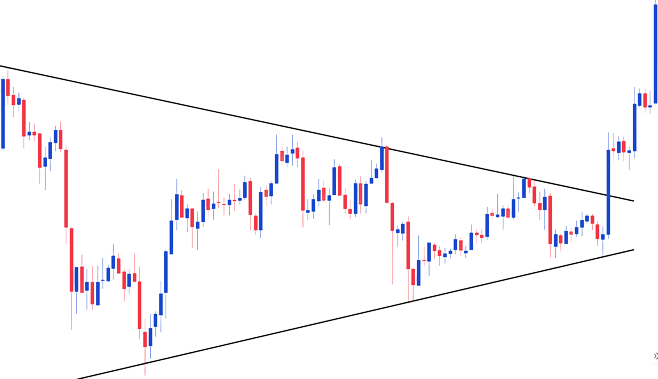

Firstly passionate about global macroeconomics and monetary policies, I then turned to so-called “chartist” technical analysis. Although different from fundamental analysis, this type of analysis seemed closer to reality to me. Indeed, even if the macroeconomics tries to predict the main future economic waves, it is quite decorrelated from reality in the short and sometimes medium terms.

Therefore, I was automatically seduced by the stocks charts which, even if difficult to tame at first sight, allow me to invest more serenely. As a consequence, I abandoned fundamental analysis for technical analysis when I was around 20 to 21 years old. Even though I am using macroeconomics data, my decision is always made through the charts.

As a consequence, during each day of these 2 following years, I deeply studied technical analysis. After having perfectly mastered Price Action and Japanese candlesticks (focusing exclusively on price only), I discovered a whole world of technical indicators and oscillators used in deep fund trading rooms of hedge funds and large investment banks. Obviously, a large number of technical indicators are sadly unnecessary. However, a handful of tools are incredibly efficient and greatly aid in chart analysis. Roughly after an additional year, I was able to surround myself with a very precise selection of technical indicators and oscillators such as the Bollinger Bands, Ichimoku Kinko Hyo, Exponential Moving Averages and the Relative Strength Index (RSI).

Thanks to the Price Action, the Japanese candlestick patterns, the Bollinger Bands, Ichimoku Kinko Hyo, the Exponential Moving Averages and the Relative Strength Index, I have been able to build a trading style that perfectly suits me and which is extremely effective. Indeed, it has been more than 4 years now since I am an independent trader and that I live easily thanks to my investments manually or via robot (trading robot created with my partner and meeting our imposed requirements).

Initially specialized in stocks, I then turned to much more liquid markets such as commodities and Forex with currency trading pairs like EUR/USD, AUD/USD, USD/CAD, GBP/USD or even NZD/USD. In addition, having discovered the cryptocurrency market between 2017 and 2018, I was also interested in it fundamentally and then technically. Becoming increasingly liquid and popular, crypto-assets now respond to technical signals, which is a boon for independent traders. Indeed, with cryptos delivering returns more than 10 times higher than those in traditional markets, it is much more profitable to trade these new assets when you have a perfect knowledge of fundamentals & technical analysis.